The tax owed to the ATO is probably one of the biggest shocks to business owners when they start generating a healthy profit. Without the right strategies in place, you could be left paying way more tax than necessary.

More often than not, business owners will try to minimise tax by maximising deductions. While deductions can be a good way to reduce tax, it’s important to remember that you are sacrificing profit to lower your tax.

Sacrificing profit means sacrificing cash in your hand.

As a business owner, your focus should not be on reducing profit to lower your tax but rather on running a successful business and generating a healthy profit. A bucket company strategy can help you do just that.

One of the best ways to reduce tax is by structuring your business and personal assets in the most tax-effective manner possible. One way to do this is to utilise a corporate beneficiary, otherwise known as a ‘bucket company’.

We can help you understand all your options and guide you through the steps of setting up a bucket company in Australia. For more information, hear from one of our directors John Liston in the below video or simply read on.

What is a bucket company?

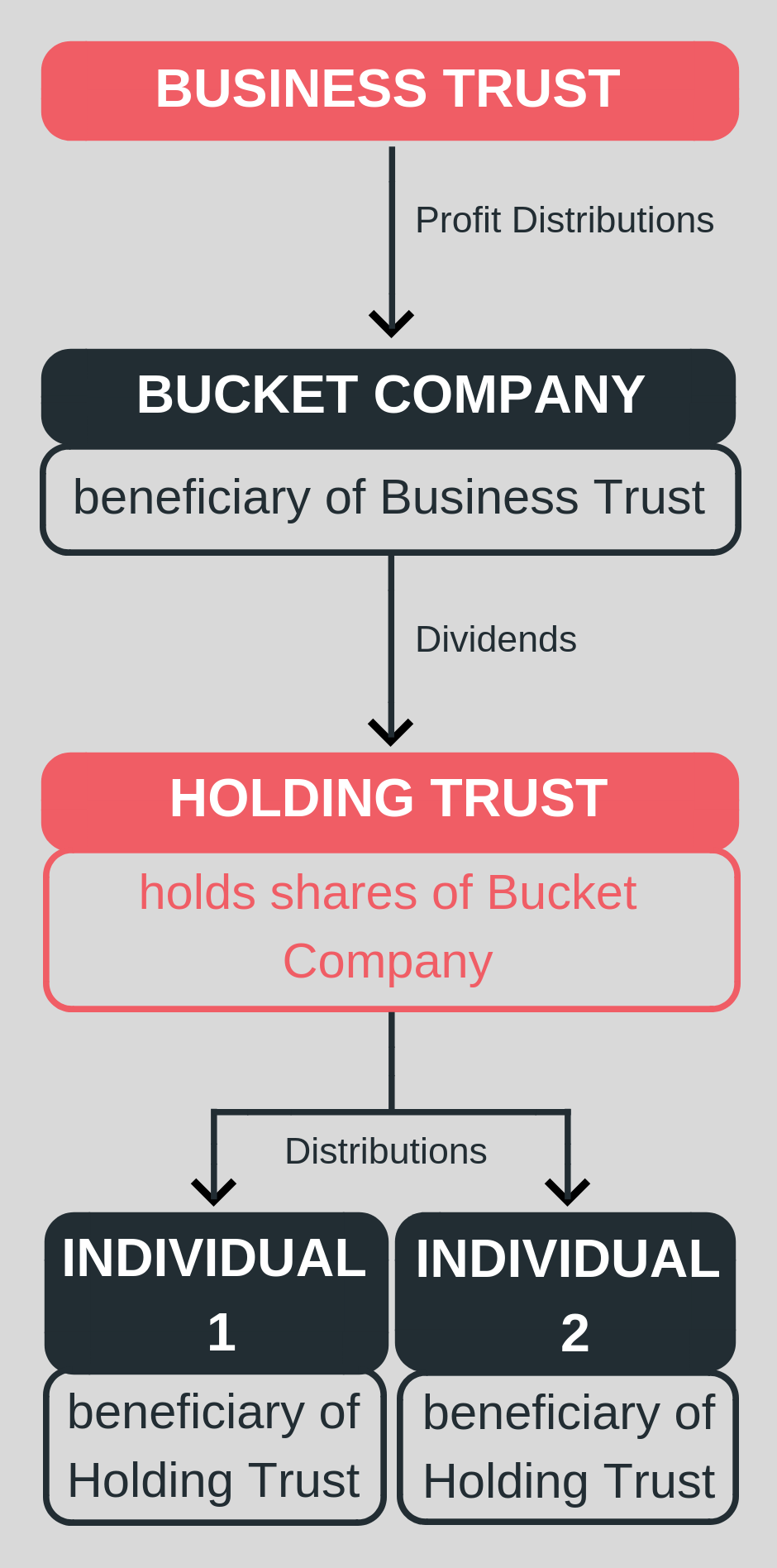

A bucket company is a company that is set up as a beneficiary to a trust. The term ‘bucket’ is used because the company sits below your trust and is used to pour money into it to reduce tax. This allows you to cap your tax payable at a corporate tax rate.

Capped tax rates:

- The corporate tax rate (using bucket company) is 25% for Base Rate Entities and 30% for all other companies*

- The individual top marginal tax rate (without a bucket company) is 49%*

- A bucket company is not owned by the trust itself, though it may be owned by a trustee.

*Tax rates accurate as of July 2022.

What is the average rate of tax?

The average rate of tax is the overall percentage of tax you have paid. For example, ifyou earned $100,000 and paid $25,000 in tax, your average rate of tax would be 25%.

Set up a bucket company to access the 25% or 30% capped tax rate

Setting up a bucket company strategy is quite straightforward. You will need to revise the structure of your trust (we recommend discretionary trusts) so it has a bucket company that you can distribute profits to. Once this is set up, it’s a matter of understanding your bucket company’s ATO obligations.

We will go into these ATO obligations in the latter part of this article, but first, here is an example of how beneficial a bucket company can be.

Example: the bucket company strategy in action

Let’s say your Australian business had a profit of $500,000. If this profit were to be paid to you as an individual, under 2023 tax rates, you would have a tax payable of $221,542 including Medicare Levy and Division 293 Tax. This is an effective rate of tax of 44%.

If we were to use a bucket company for this business, then the most tax-effective way to distribute the $500,000 in profit is to allocate the first $45,000 in profits to you. You will pay $0 tax on the first $18,200 distributed to you and then 19 cents in every dollar until $45,000.

After you have paid yourself $45,000, it becomes tax effective to distribute the remaining profits to your bucket company. If you distribute to a company, then for every dollar after $45,000, you will pay the tax rate of 25 cents of every dollar in tax.

If you chose to receive the income yourself, from $45,000 onwards, you would pay 32.5 cents of tax in every dollar up to $120,000. You would then pay 37 cents for each dollar after $120,000 and 45 cents for each dollar after $180,000, as well as a 2% Medicare levy.

- Tax paid without a bucket company: $221,542

- Tax paid with a bucket company: $119,417

- Total savings: $102,125

Considerations when utilising the bucket company strategy

Commitment to distributions

Suppose you elect to distribute to the bucket company for the Financial Year. In that case, a physical distribution for the same amount must be made to the company’s bank account before lodgement of the tax return.

Note: if you cannot meet your bucket company ATO obligations, you will be allowed a 7-year repayable loan (between the trust and the bucket company) with interest charged at benchmark rates. This is called a Div 7A Loan.

Div 7A Loan

A Div 7A loan agreement is a loan between the trust that is distributing the profits and the company that is receiving them.

If the trust doesn’t pay all the distributions in cash before the tax return is lodged, then a Div 7A loan is created.

A Div 7A loan:

- Has a maximum term of 7 years

- Has a minimum annual repayment plan

- Has interest that is payable at a commercial rate prescribed by the government

The minimum repayments need to be met by the trust physically making payments to the bucket company each year. However, it may be possible for the bucket company to declare dividends that can be offset against the minimum repayment obligation.

How to get money out of a bucket company

Getting money out of a bucket company is done by paying a dividend to the shareholders. Because the dividend has already been taxed at the company tax rate, the shareholder receives a franking credit on the tax already paid.

Note: a franking credit allows you to pass on tax paid at a company level to shareholders.

Who should hold the company shares?

You need to put some thought into who the shareholders of the company will be.

If they are individuals, then this does not allow much flexibility in how the dividends are distributed. The dividends need to be distributed exactly according to the shareholder percentage.

[free_strategy_session]

Book a free financial strategy session

A 90-minute strategy session gives you a clear plan for your bucket company.

- Get a better understanding of your needs

- We generate a detailed report from your strategy session

- Understand your priorities and next steps

[/free_strategy_session]

Optimising your bucket company structure

A smart thing to do is to set up another separate trust to hold the company's shares. That way, the trust can distribute the dividends in the most tax-effective manner.

Holding the shares in a trust is also beneficial from an asset protection perspective. Over time, if a large amount of profit is distributed to the company, the company will have a lot of value. If the individual holds the shares, this can leave the individual exposed in the event of legal proceedings.

Holding the shares in a separate trust will create another layer of asset protection, whilst also providing extra flexibility on how to tax-effectively distribute the dividends.

What to do with the money in the bucket company

A bucket company can be an excellent structure to hold long-term investments. Effectively, the bucket company can become an investment company that seeks to generate another income source for the owner. As cash is transferred across from a trust into the company, the cash can then be invested.

Examples of investments include listed shares, properties, and private investments.

When investing via a company, you need to be mindful of how companies are taxed. Companies are not eligible for the 50% capital gains tax discount, while trusts and individuals can access a 50% CGT discount if an asset is held for more than 12 months. Also, any profit within a company is taxed at the current corporate tax rate of 25%.

However, if you have distributed to a company to save tax, it is likely this will still be under your own personal tax rate. This is where a good accountant can advise you on how to create a tax minimisation strategy best suited to your situation.

Minimise the tax your business is paying

Whilst distributing to a company may be the most tax-effective strategy, it may not always be the most practical. No matter what your situation, Liston Newton Advisory can provide you with options on how to effectively minimise your tax.